Commentary for 2023 October thru December

We start every quarter with a blank page. Previous pages are still available by these links:2023 Jan-March, 2023 April-June, 2023 July-Sept, 2023 Oct-Dec,

2024 Jan-March, 2024 April-June, 2024 July-Sept, 2024 Oct-Dec,

FEDERAL JUDGE REJECTS PRESS FREEDOM CLAIMS BY PROJECT VERITAS IN ASHLEY BIDEN DIARY CASE

Wednesday, December 27, 2023

By Ryan Morgan

A federal judge in Manhattan has ruled that investigative journalism outfit Project Veritas should have to turn over documents detailing how the organization came into possession of the alleged diary of President Joe Biden's daughter, Ashley Biden.

On Thursday, U.S. District Judge Analisa Torres of the Southern District of New York ruled in favor of a special master's recommendation that Project Veritas should be made to turn over all documents in its possession that detail how it came into possession of the diary in the fall of 2020. Judge Torres ruled against claims by Project Veritas that it has journalistic non-disclosure privileges under the First Amendment and thus should not be made to turn over its records.

With Judge Torres's ruling, federal prosecutors could soon take possession of more than 900 documents detailing how Project Veritas came into possession of the diary. Judge Torres ordered a government evidentiary filter team to sort out any documents not protected under attorney-client privilege and turn those documents over to government investigators by Jan. 5.

The legal battle over Ms. Biden's alleged diary began in the fall of 2021, when federal agents carried out search warrants at the homes of several Project Veritas employees, including the group's founder and then-CEO James O'Keefe. Project Veritas has asserted that federal investigators should be compelled to return records seized from the organization, arguing that the records seizure violated their First Amendment rights as a press organization.

Project Veritas had specifically argued that past legal precedents had protected news organizations from liability for publishing information, even when said information was acquired illegally by an intermediary. Judge Torres, an appointee of President Barack Obama, ruled that such precedents don't protect Project Veritas in this case because federal prosecutors are treating the press organization as an active participant in the theft of Ms. Biden's alleged diary, rather than a simple recipient of unlawfully obtained information.

"The Supreme Court held that the First Amendment protects the publication of information by a 'law-abiding possessor of information,' even if the publisher received the information from a source who obtained it unlawfully," Judge Torres wrote. "Here, the Government is investigating whether [Project Veritas and its members] participated in the theft of the Victim’s journal and the other items."

Ms. Biden's alleged diary was discovered by defendants Aimee Harris and Robert Kurlander. Without naming Ms. Biden specifically, federal charging documents state "an immediate family member of a then-former government official who was a candidate for national political office" had stored the diary at a private residence in Delray Beach, Florida.

Project Veritas has contended that it received the diary through a pair of tipsters, whom they referred to as A.H. and R.K., who approached the organization. Project Veritas further asserted that the diary was not stolen, but simply abandoned by Ms. Biden and subsequently found by their tipsters.

“Project Veritas had no involvement with how those two individuals acquired the diary. All of Project Veritas’s knowledge about how R.K. and A.H. came to possess the diary came from R.K. and A.H. themselves," Paul Calli, an attorney representing Project Veritas, has said of the case.

Ms. Harris and Mr. Kurlander each pleaded guilty last summer to one count of conspiracy to commit interstate transportation of stolen property.

Project Veritas paid $40,000 in total for receipt of Ms. Biden's alleged diary and related materials, but the press organization ultimately opted not to release the diary or run any news stories on it. Project Veritas said it reached out to an attorney for the president's daughter and offered to return the diary, but said her attorney refused to authenticate it. The organization said it subsequently handed the diary over to law enforcement officials in Florida.

Project Veritas has not been charged in connection with the diary case. The press organization has said the ongoing federal investigation "seems undertaken not to vindicate any real interests of justice, but rather to stifle the press from investigating the President’s family."

Attorney Jeffrey Lichtman said on behalf of Project Veritas on Monday that the organization's legal representatives are considering appealing Judge Torres's ruling.

The Associated Press contributed to this article.

LONG-TERM USE OF STATINS LINKED TO HEART DISEASE

Monday, December 18, 2023

By Vance Voetberg

For decades, statins have been heralded as the reliable heroes in the battle against heart disease, the leading cause of death in the United States and globally. However, this seemingly flawless reputation has been called into question.

A new expert review suggests that long-term use of statins may be inadvertently aiding the enemy by accelerating coronary artery calcification instead of providing protection.

STATINS DEPLETE HEART-PROTECTING NUTRIENTS

The review, published in Clinical Pharmacology, suggests statins may act as “mitochondrial toxins,” impairing muscle function in the heart and blood vessels by depleting coenzyme Q10 (CoQ10), an antioxidant cells use for growth and maintenance. Multiple studies show statins inhibit CoQ10 synthesis, leading many patients to supplement.

CoQ10 is vital for producing ATP, the cell’s fundamental energy carrier. Insufficient CoQ10 inhibits ATP production, resulting in an energy deficit that the review authors say “could be a major cause for heart muscle and coronary artery damage.

“We believe that many years of statin drug therapy result in the gradual accumulation of mitochondrial DNA damage,” according to the authors.

A 2022 study published in Biophysical Journal linked reduced ATP to heart failure.

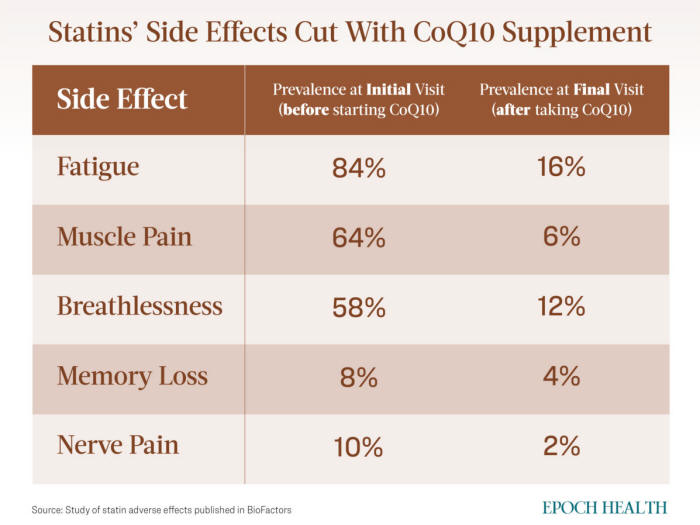

A 2008 study published in BioFactors reaffirms the statin–CoQ10 link. Researchers evaluated 50 statin patients for side effects like fatigue and muscle pain. All then stopped statins and supplemented CoQ10 for 22 months on average.

Heart function improved or held steady for the majority of patients. The researchers conclude statin side effects, including statin cardiomyopathy, “are far more common than previously published and are reversible with the combination of statin discontinuation and supplemental CoQ10.”

STATINS DEPLETE VITAMIN K, RAISING HEART CALCIFICATION RISK

Statins impair the production of vitamin K, an essential vitamin in managing calcification, according to the review. Optimal vitamin K2 intake helps avoid plaque buildup of atherosclerosis—thickening or hardening of the arteries—and keeps calcification risk low.

Coronary calcification happens when calcium accumulates in the walls of the coronary arteries that provide oxygen to the heart. This plaque buildup is a sign of early coronary artery disease, which can block blood flow and trigger a heart attack.

A 2021 study published in the Kaohsiung Journal of Medical Sciences found a connection between statin use, coronary artery calcification, and vitamin K2 deficiency. The results shed light on how statins may spur arterial calcium accumulation by inhibiting vitamin K. The study’s findings were “in agreement with the existing evidence about positive association between statins and vascular calcification,” the authors added.

Statins also damage selenoproteins, carriers of the mineral selenium essential for heart health.

Statins were also linked to increased calcification in a 2022 study published in Arteriosclerosis, Thrombosis, and Vascular Biology. However, the authors proposed that statins may encourage calcification by heightening inflammation rather than nutrient deficiency.

PHYSICIANS OVERLOOK STATINS AS DRIVER OF HEART FAILURE: EXPERTS

Based on emerging evidence on statins’ potential cardiac downsides, the authors of the new review warn that “physicians in general are not aware that statins can cause heart failure and are clearly not recognizing it.” Though doctors readily diagnose heart failure in statin users, they usually attribute it to factors like age, high blood pressure, or artery disease.

Doctors prescribing cholesterol drugs “cannot ignore the moral responsibility of ‘informed consent,’” the researchers wrote, noting that patients deserve full disclosure of side effects like cardiovascular disease or heart failure.

With over a million annual heart failure hospitalizations in the United States, the condition is often referred to as an epidemic—and it may be that “statin drug therapy is a major contributing factor,” according to the review.

FBI DIRECTOR WARNS 'ELEVATED' RISK OF INFLUENCE IN 2024 ELECTION

Friday, December 15, 2023

By Jack Phillips

FBI Director Chris Wray says that his agency is 'keenly focused' on the matter.

The FBI believes there is an "elevated" risk of outside election interference or influence in the 2024 presidential election, according to its director, Christopher Wray.

"I think it’s fair to say that they are elevated from where they were before," Mr. Wray told a Senate committee last week. "And to elaborate just slightly on that point, obviously we saw, and it’s not disputed, that the Russians tried to interfere in the 2016 election and then continued. But what we’ve seen since then is other adversaries attempting to take a page out of the Russians' playbook."

He added that the FBI and other national security officials are "keenly focused" on the threat of potential election interference in 2024 elections. That includes focusing on "the risk that foreign adversaries, whether it’s Russia, whether it’s China, whether it’s Iran or others, would seek to interfere in our elections," he continued.

"It is not seriously disputed that our foreign adversaries have tried and are continuing to try to interfere in our elections," Mr. Wray, who has been the head of the FBI since 2017, told the lawmakers.

For years, former President Donald Trump has said that he believes the 2020 election was stolen and rife with fraud—namely around mail-in ballots. He has also warned that recent criminal cases against him are tantamount to a form of election interference ahead of the 2024 election.

Meanwhile, Democrats and some corporate news outlets, citing anonymous and spurious sources, have claimed that Russia worked with President Trump to help him win the 2016 election, although those claims were mostly debunked in subsequent investigations. President Trump has long said that the Russia collusion claims were a hoax and merely an attempt to harm his political chances.

Mr. Wray made no mention of either of those claims during his recent congressional testimony.

In October, President Trump said that if elected, he "will secure our elections, and our goal will be one-day voting with paper ballots and voter ID," adding that "until then, Republicans have to compete, and we have to win." He called on his supporters to vote early and "harvest" ballots in order to "beat the Democrats at their own game," referring to mail-in balloting.

MICROSOFT WARNING

Several weeks ago, major software company Microsoft warned that China, Russia, and Iran are likely to engage in influence and interference efforts ahead of the 2024 presidential election, according to its analysts.

"For Russia, Iran, and China, the next U.S. president will define the direction of conflict—whether wars might occur, or peace might prevail," said the new report from the company, released in November. The three countries are "unlikely to sit out next year's contest ... the stakes are simply too high."

"America's social media ecosystem today is far more visual than in previous years," the analysis said. "Memes, gifs, podcasts, video clips, and influencers are the means of today's influence operations—not bots and pithy text posts."

It added that over the past three years, the Chinese Communist Party (CCP) "has dramatically scaled up the scope and sophistication of its overt and covert influence activity around the world and expanded its covert social media operations, undertaking light influence activity during the 2022 US midterm elections," Microsoft said.

The company has "observed some China-affiliated inauthentic social media personas and accounts infiltrating U.S. audiences and posting divisive and inflammatory content about American candidates," according to the report.

Neither the firm nor Mr. Wray made any mention of TikTok, a social media platform often used by younger Americans that is owned by ByteDance, a China-based company with reported ties to the CCP.

Some Republicans have said that TikTok should be banned in the United States or, at the very least, sold to another company in order for it to operate. A number of countries have banned the social media app, including India and Nepal.

The report also came as a federal U.S. attorney of the central district of California, Martin Estrada, issued a warning about the Chinese regime's attempts to influence U.S. elections.

“We’re the gateway to Asia,” Mr. Estrada told House Judiciary Committee members, referring to California. “And we have the People’s Republic of China trying to influence our elections, trying to target some of our individuals.”

In September, the Canadian government announced an investigation into whether China, Russia, or other nations interfered in the 2019 and 2021 Canadian general elections.

Opposition Conservative lawmakers have demanded a full public inquiry into alleged Chinese interference since reports surfaced earlier this year citing intelligence sources saying China worked to support the Liberals and to defeat Conservative politicians considered unfriendly to Beijing.

Earlier this year, Canada expelled a Chinese diplomat whom Canada’s spy agency alleged was involved in a plot to intimidate an opposition Conservative lawmaker and his relatives in Hong Kong after the Conservative lawmaker criticized Beijing’s human rights violations. China then announced the expulsion of a Canadian diplomat in retaliation.

The Associated Press contributed to this report.

COMMISSIONER DVORAK COMMEMORATES A NEW CORNERSTONE FOR GEAUGA

Thursday, December 14, 2023

Tuesday, December 12, 2023, was a busy day for Geauga County Commissioner, Jim Dvorak, who found himself one of two Commissioners presiding over the Commissioners’ eight-item agenda, then taking part in the ground-breaking for the Geauga County Courthouse renovation and addition at noon, and then finally, the sole Commissioner attending the 2 pm ADP meeting.

Mr. Dvorak recalled the Cornerstones of Life that his own late father provided to him so that he could advance “from being a Craftsman to a Commissioner.”

Mr. Dvorak in his research, discovered that the Geauga Courthouse characterized by High Victorian Italianate architecture, local red brick and light sandstone, was undertaken as the rebuilding of a previous courthouse destroyed by fire at a recorded price of $88,862. The first official court session occurred in the new Italianate building at least a year later on August 23, 1879.

This editor thanks Commissioner Dvorak for providing a copy of his prepared remarks for those gathered. Commissioner Dvorak’s rhymed devotional, Cornerstones, by Karen Barber, seeks to explain that

“. . .the seeds of Truth be sown

Where we lay this Cornerstone.”

OHIO GOV., LT. GOV. ON HOT SEAT

The Toledo Blade Editorial Board

Tuesday, December 5, 2023

The citizens of Ohio take a backseat to the pension fund for Los Angeles County employees when it comes to getting to the bottom of the worst corruption scandal in state history.

The California fund is forcing Ohio Gov. Mike DeWine to produce documents and

Lt. Gov. Jon Husted to testify under oath about the FirstEnergy bribery scandal.

This is a civil case, and the details may never be disclosed, but those details

should be disclosed.

The California fund is forcing Ohio Gov. Mike DeWine to produce documents and

Lt. Gov. Jon Husted to testify under oath about the FirstEnergy bribery scandal.

This is a civil case, and the details may never be disclosed, but those details

should be disclosed.

Holders of FirstEnergy shares lost $7.68 billion when the stock sank 35 percent following FBI arrests alleging that company-paid bribes of approximately $60 million were behind a $2 billion windfall to the Akron utility in House Bill 6. In 2019, Ohio lawmakers passed legislation that subsidized two FirstEnergy nuclear plants and locked in artificially high electric rates for seven years.

The scheme has resulted in two convictions, two guilty pleas, and a suicide but no Statehouse investigation of how it happened or how to prevent future scandal.

Both Mr. Husted and Mr. DeWine should be questioned over the decision to make FirstEnergy consultant Sam Randazzo chairman of the Public Utilities Commission of Ohio.

FirstEnergy’s deferred plea agreement with a $230 million fine confirmed that it paid Mr. Randazzo $22 million as a consultant and that $4.3 million of that total was a bribe for his assistance in structuring the nuclear bailout and locking in electric rates at the top of the scale. An 11-count felony indictment against Mr. Randazzo was revealed by the Justice Department Monday.

Mr. Randazzo and FirstEnergy executives deny any wrongdoing. But text messages made public in the corruption trials of former Ohio House Speaker Larry Householder and former Ohio Republican Party Chairman Matt Borges show FirstEnergy executives celebrating “battlefield triage” by Mr. DeWine and Mr. Husted to push Mr. Randazzo’s appointment through the PUCO Nominating Council.

Mr. Randazzo’s conflict of interest was known to the governor and lieutenant governor and his appointment was crucial to the criminal conspiracy to pass HB 6. Mr. Husted was shown in documents from the conspiracy trial to have been the legislative point person for locking in FirstEnergy’s rates at the top of the scale.

Plaintiffs’ lawyers will grill Mr. Husted on his actions in enacting a bill that served FirstEnergy better than it did ordinary Ohioans. Investors should put Governor DeWine under oath too, as none of the scandalous activities that crashed FirstEnergy stock could have happened without him.

It’s regrettable but not surprising that investors damaged by the FirstEnergy scandal are more aggressively investigating than Ohio lawmakers.

HOWLAND NAMESAKE FELL OFF THE MAYFLOWER

November 17, 2023 |

HOWLAND – If nothing else, do not fall off the boat. It is easy to imagine that this was the unspoken first rule for the Pilgrims traveling to America on the Mayflower in 1620.

A hired hand, John Howland was probably trying to follow it, but during a storm, he was thrown overboard and nearly drowned.

The story ends well though, and five generations later, his descendant, Joseph Howland, founded the present-day township in Trumbull County that shares his name.

“This is the story of an American family. This is what America is all about. You work hard, make a name for yourself and you’re successful,” said Louisa Howland Miller, 65, of Vienna.

She is a descendant of Howland and passed along William Bradford’s “On Plymouth Plantation,” which records a firsthand account of the Pilgrims’ journey on the Mayflower and their settlement. The following is what Bradford wrote on John’s accident (the original spellings are left intact):

“In sundrie of these stormes the winds were so feirce, and the seas so high, as they could not beare a knote of saile, but were forced to hull, for diverce days togither. And in one of them, as they thus lay at hull, in a mighty storme, a lustie yonge man (called John Howland) coming upon some occasion aboye the grattings, was, with a seele of the shipe throwne into [the] sea; but it pleased God that he caught hould of the top-saile halliards, which hunge over board, and rane out at length; yet he held his hould (though he was sundrie fadomes under water) till he was hald up by the same rope to the brime of the water, and then with a boat hooke and other means got into the shipe againe, and his life saved.”

Eleven generations later, John’s family was able to celebrate a Thanksgiving feast with a unique connection to the Pilgrims’ voyage.

“He basically should have drown. It was a miracle because in that day, people didn’t learn how to swim,” said Miller.

Miller was the first in the Howland line to move to the area. She came from New York City in 1970 without knowing the area’s history until her father pointed out that their family had once owned the township’s land. She then dug a little deeper.

“It was through my father who’s the family historian and genealogist and he was president of the Pilgrim John Howland Society…” she said. “He came to visit shortly after we arrived and said he wanted to go to Howland. We took a tour of the town and he was just thrilled to see the property that Howland had owned.”

According to Bradford, being thrown overboard took an effect on John’s health, but not enough to prevent his success in the new world.

“Though he was something ill with it, yet he lived many years after, and became a profitable member both in church and commone wealthe,” Bradford wrote.

John signed the Mayflower Compact and went on to have 10 children with his wife, Elizabeth Tilley, whom he married in America sometime before March 25, 1624, according to the General Society of Mayflower Descendants.

It was John’s great-great-grandson Joseph, born in 1749, who bought the land of Howland Township. He purchased 15,584 acres of land for $12,903 from the Connecticut Land Company as an investment in 1798. However, Miller said, Joseph never made it out to the area. He lived most of his life in Boston, Connecticut and New York City.

Harriet Taylor Upton, who compiled a history of the county, described Joseph as “a cultured gentleman,” in her historical account. She also noted that the first tract of 1,600 acres was sold in 1799 to John Hart Adgate, whose descendants began the well-known local florist company still in existence.

In 1812, the land was declared a separate township, Howland – or “The High Land” – by the Trumbull County Board of Commissioners. It is a place Miller said she holds dear.

“The people of Howland have been so welcoming. I feel like I’ve come home,” she said.

Enjoying this year’s Thanksgiving with her family, Miller said it would be a much different place if John had drowned. She is grateful for the ability to once again share the family’s story with her two young granddaughters.

“We’ve always been very proud of our heritage and I’m glad to be able to tell my grandchildren something about each of their ancestors.”

Editor’s note: Excerpts of “Of Plymouth Plantation” are taken from the Early Americas Digital Archives of the University of Maryland. Over 2 million people in the U.S. today can claim John Howland as one of their direct ancestors. John Howland arrived as an indentured Quaker servant. He was my 12th great grandfather.

LESS TAXES, MORE TURKEY

Tuesday, November 21, 2023

Excerpts from Carolyn Brakey

Ready to turn the tables on rising property taxes this Thanksgiving?

As we prepare to share God’s bounty, I am reminded of the importance of defending our community from the impending Geauga Tax Hike.

This Thanksgiving, Geauga residents should be enjoying time with family and focused on passing the gravy boat — not worrying about whether they can continue to afford their homes.

But property tax hikes are scheduled to hit Geauga homeowners next year and many of our neighbors (especially seniors on fixed incomes) have been rightfully concerned.

Across Geauga County, families recently received the startling news in their mailboxes from the County Auditor’s Office. Notices of property revaluations (with increases exceeding 40% for some families) would result in a big tax hike for property owners absent action by our elected officials.

But thankfully, we are fighting back and making a difference.

As a candidate for Geauga County Commissioner, I launched a petition telling our elected officials to “Stop the Geauga Tax Hike” by reducing levied tax rates to offset the state-ordered revaluation.

It’s pretty simple actually.

With $9.6 million in higher taxes scheduled to flow into county and local government, elected officials can choose to either (1) spend that money to grow government, or (2) identify levies to suspend so taxpayers keep their hard-earned money and can afford to stay in their homes.

I believe that taxpayers should keep the money they earn.

Thankfully over 1,400 people have already signed our petition to “Stop the Geauga Tax Hike!”

Inflation is bad enough, and many of our neighbors cannot absorb a property tax spike without risk of losing their homes.

That’s why I am running for Geauga County Commissioner — to cut taxes, restore freedom, and end government dysfunction.

We simply cannot afford:

… the dysfunction that has plagued county government — as corruption charges, FBI raids, and senseless infighting have brought important business to a halt;

Responding to our petition, Geauga County Commissioners have taken steps to suspend and partially suspend two levies, directly countering the county's tax increases.

Following this example, 12 of the 16 townships and 3 of the 4 villages have already acted or are actively working to reduce the increase. From suppressing police levies to cutting down windfalls, they're heeding the call.

Chuck Walder, our Geauga County Auditor, is not only being kept updated on the petition's progress but he continues to use it in his discussions with taxing entities. This ensures that the impact of our voice is felt and acknowledged at every level.

But there is still more work to be done — especially with out school districts. Let’s keep up the pressure to stop the tax hike.

Happy Thanksgiving!

Carolyn Brakey

Republican for Geauga County Commissioner

HOMELAND SECURITY CHAIR BLASTS BIDEN AS COAST GUARD CATCHES MORE MIGRANTS

Sunday, November 19, 2023

Casey Harper | The Center Square

President Joe Biden is under fire after a new report that the number of illegal immigrants caught by the Coast Guard trying to enter the U.S has doubled in recent years.

That data came from Heather MacLeod, director of Homeland Security and Justice at the Government Accountability Office during a hearing this week.

"The Coast Guard interdicted more than 12,000 migrants in both fiscal year 2022 and 2023 – more than double the fiscal year 2021 total, according to Coast Guard data," MacLeod said in prepared testimony.

House Homeland Security Committee Chairman Mark Green, R-Tenn., responded to The Center Square’s reporting on the increased interdictions, saying President Joe Biden’s immigration policies are endangering U.S. servicemembers.

"Historic numbers of encounters at our Southwest border are certainly the main driver of this unprecedented crisis, but they aren’t the only one," Green told The Center Square. "Illegal aliens also try to take advantage of America’s maritime borders. This route is incredibly dangerous for not only the aliens, but also the men and women of the U.S. Coast Guard and the Air and Marine Operations officers tasked with interdicting the flow of illegal immigration and deadly narcotics along these routes."

Green blasted Biden for the illegal immigration crisis, which has soared since Biden took office with about ten million illegal immigrants entering the U.S. since January of 2021.

"Every day, the Coast Guard plays a crucial role in securing our waterways, and it is unconscionable that Secretary Mayorkas and President Biden continue to make their job harder through their policies of mass catch-and-release that have encouraged more individuals to attempt this route, and emboldened the cartels to traffic more drugs," Green said.

MacLeod said the U.S. should expect that number to rise. While land crossings make up the vast majority of migrant crossings, water transport could allow groups to ship bigger quantities of illicit drugs.

"Every year, thousands of people attempt to migrate via maritime routes, many utilizing services of organized smuggling operations and often in dangerously overloaded, unseaworthy, or otherwise unsafe vessels," Rear Admiral Jo-Ann Burdian, Assistant Commandant for Response Policy (CG-5R) for the U.S. Coast Guard, testified at the same hearing. "Many of the migrant interdiction cases handled by the Coast Guard begin as search and rescue missions.

"The Coast Guard employs cutters, boats, fixed-wing aircraft, and helicopters to identify and interdict migrant vessels as far from U.S. shores as possible," Burdian added.

In one 2021 case, the Department of Justice announced that six Colombian nationals had pleaded guilty to conspiracy to use "narco-submarines" to ship nearly 20,000 kilos of cocaine to the Sinola Cartel in the U.S.

MacLeod testified that the number of migrants attempting to enter the U.S. by sea will likely continue to rise.

"From fiscal years 2011 through 2020, drug interdiction accounted for 13 percent of [the U.S. Coast Guard’s] estimated operating expenses, migrant interdiction 8 percent, and other law enforcement 2 percent, which includes preventing Illegal, Unreported, and Unregulated fishing," MacLeod said. "The operating expenses of these three missions annually averaged more than $1.5 billion over this time period."

The U.S. Coast Guard works with DHS and the Department of Defense to stop the flow of illicit drugs into the U.S..

Coast Guard and Maritime Transportation Subcommittee Chairman Daniel Webster, R-Fla., led the hearing this week and pointed out the dangers to the migrants attempting these water voyages as well as the Americans being poisoned by drugs like fentanyl, which has killed tens of thousands of Americans in recent years.

"The Coast Guard is our nation's premier maritime law enforcement agency and is actively engaged in countering illicit maritime activity," Webster said in his opening remarks at the hearing. "This includes stopping the flow of illegal drugs to our shores, interdicting illegal maritime migration, and protecting the environment through efforts to curb illegal fishing."

ANALYSIS OF AUBURN TOWNSHIP’S ROAD AND BRIDGE LEVY “OOPS”

Friday , November 17,2023

Readers of this website will recall our video coverage of Christopher Hitchcock’s investment report to Geauga Commissioners. He gave assurances that the Geauga Treasury coffers were full with no further need of any monies. In fact, he expressed misgivings about the unprecedented negative mood of Geauga property owners when their real estate bills arrived shortly after the arrival of a dystopian New Year. He already knew in late summer 2023 that there was going to be an unprecedented level of non-payment possibly leading to late payments and even more foreclosure actions when taxpayers would have to deal with deciding whether to pay for food, medicines, transportation, or try to pay for unprecedented windfalls for school districts and local and county governments. . .

Shortly thereafter Auburn Trustees held the September 5, 2023, meeting in pretty good spirits after the Great Geauga Fair. Trustee PJ Cavanagh announced soberly that while in Giant Eagle, he had received a call from the [Geauga] Prosecutor’s Office, an event “that’s never good.”

Trustee McCune looked preoccupied with something in his hands. An assistant prosecutor recorded “a clerical” error in the 1 mill Road and Bridge Levy scheduled for the November 7 election because the levy had not been renewed after 2015. No one in Auburn public office has offered to rescind the 1 mill payments that Auburn taxpayers apparently dished out during the time when the particular Road and Bridge levy had ended. (September 5 video) On the contrary, we heard Trustee Troyan extend blame on Covid pandemic, the need to work from home, and the possible negligence of the Geauga County Auditor. It seems to us that there is plenty of blame to go around. . .

At the Monday, October 3, Auburn meeting we heard plans to submit a brand new 1 mill Road and Bridge levy. Remember, the original 1 mill R&B levy had lost its ability to be renewed because the long-term Auburn fiscal officer had failed to legally renew the issue after 2015. No one chose to talk about the consequence of that oversight, the Great Oops that would likely penalize Auburn taxpayers for a huge amount of time.

Shortly after Hitchcock’s Great Investment Revelation, otherwise known as no need for extra funds; along with Auburn Trustees’ bevy of excuses, the Geauga Budget Commission called two public meetings in less than two weeks, in mid October and on November 1. It was on the Wednesday, November 1, meeting intended for township, village, and Chardon City elected officials (which these long-term Auburn citizens also attended) that the Budget Commission (aka Christopher Hitchcock, Prosecutor Jim Flaiz, and Auditor Chuck Walder) implored public officials to demonstrate willingness to suspend payment of levies for one year until the Ohio Legislature could step in and clean up language loopholes in Ohio House bills like HB 263. The Budget Commission implored that without relief to beleaguered taxpayers on fixed incomes, the townships, villages, and county might expect taxpayer faith and loyalty to disappear. Auburn Trustee PJ Cavanagh was present for the first public meeting; Auburn Trustee Gene McCune sat two rows behind these editors at the November 7 meeting. Mr. McCune even waved to us.

Never the less, at the Monday, November 6, Auburn meeting we were disturbed to hear Trustee McCune report that because the latest Road and Bridge levy had been removed from the November 7 ballot because of its “clerical error,” [otherwise known as GROSS NEGLIGENCE to most voters] Auburn Township should be held in high regard even if Auburn Trustees were covering for past mistakes.

His big concern was that readers of newspaper and print media accounts would soon learn that Auburn Township trustees had not yet extended their willingness to suspend R&B collections—if only for a year--. Nevertheless, Trustee McCune publicly bemoaned the extra $125 on his “small house” just because he lived “just across the street “ from Sablewood residences selling in 2020, 2021, and 2022 for over $1 million. Nevertheless, he did not want citizen groups in Auburn to resent the apparent inaction of Auburn Township officials to help Auburn property owners when so many elected Geauga officials had already responded enthusiastically to suspend levies for a year. Sorry, Mr. McCune, if we don’t buy the line. . .

We have been quiet as we have gathered more information. Surely, we must conclude that Auburn Township officials have known about a bigger cushion of “unused” funds than they have acknowledged, particularly with disappearing ARPA funds and perhaps some other vagaries. We are grateful that we have videos of Auburn meetings since 2011 to help keep “goal posts of good government.”

We owe a huge note of gratitude to several modern-day heroes and heroines who continue in this unprecedented financial abyss to assist fellow taxpayers.. In a word, we are extending our heartfelt thanks to Newbury resident and 2024 Geauga County Commissioner candidate, Carolyn Brakey, for gathering the signatures of 1000 Geauga County taxpayers expressing their vehement disapproval of more taxes without any representation.

Additionally, we are extending our heartfelt thanks to Auburn Township residents, Bill and Linda Nokes, who have personally distributed their thoughts (See Linda’s note on November 13) and provided contact information for Auburn Township Trustees, Kenston School Board Reps, and State Legislature representatives. God bless you, Bill and Linda!

Finally, to Lake County advocates, Brian Massey and Leonard Gilbert, who drove together for a round trip of 4½ hours to provide favorable testimony on HB 263 before the Ohio House of Representatives on November 14 we extend our sincere appreciation. Many, many thanks, Brian and Leonard!

So far, we are not impressed with Auburn Trustees’ and Kenston Local School District’s [aka Superintendent Sayers] inability to demonstrate their sincerity to help local taxpayers. The longer that entities sitting on a huge windfall fail to model charity at home, the less willing voters will be willing to support the next request for monies.

LAKE COUNTY CITIZENS TRYING TO MAKE A DIFFERENCE

By Brian Massie, A Watchman on the Wall, Average Citizen

Friday, November 17, 2023

My Christian brother and good friend Leonard Gilbert and I had an opportunity to speak to the State of Ohio’s House Ways and Means Committee on Tuesday, November 14th at the State Capitol Building. We were there to provide proponent testimony on HB 263. It is proposed legislation that would freeze property tax increases for those citizens 70 years of age, and earn less than $70,000 in annual income. Leonard has spoken before a House Committee before, but it was a first time for this average citizen.

|

|

THE DECLARATION OF INDEPENDENCE FOUNDED A THEISTIC REPUBLIC

Monday, November 13, 2023

By Steel Brand

Mike Johnson opened his tenure as Speaker of the House with a speech citing the creator God mentioned in the Declaration of Independence. The speech drew criticism from columnists in the Washington Post, Time, PBS, and the New York Times, among others. Much of it shifted between Johnson’s support of Trump, his church affiliations, and his penchant for employing biblical language.

Each of the columns raced to the accusation that Johnson is a Christian nationalist. Yet none of them offered a counterargument to the fact that the Declaration of Independence actually does reference God in the course of justifying America’s separation from the British. The Declaration in fact makes four references to God, using the parlance of the 18th century.

The first reference is in its opening paragraph, which appeals to “the Laws of Nature and of Nature’s God,” thus grounding the legitimacy of the new “thirteen united States of America” in natural law and its divine author. This nation endeavors to conform to God’s moral order from its inception.

The second reference comes in the first sentence of the next paragraph and is the most famous: “that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty, and the pursuit of Happiness.” The securing of these rights concisely expresses the American understanding of government’s purpose. Government derives its “just powers from the consent of the governed.” But both government and the people are subordinate to the Creator, who stands outside the material world and brought all things into existence.

Thomas Jefferson and the Second Continental Congress presumed a common (although not coerced) belief in God. Without God, the fight for independence was unjust. Without God, the new nation had no duty to protect life and liberty. Without God the people’s right to pursue happiness, understood by the founders as the classical pursuit of goodness and virtue, would deserve no mention. Without God, the Declaration’s claims become sophistry, because the very concepts of justice, goodness, and truth are subject to constant redefinition based on the whims of the moment.

This understanding of God-given rights is why another body of representatives, including six who had signed the Declaration, enshrined religious liberty in the Constitution. Some things belong only to humanity’s Creator and must remain untouched by human officials. America’s limited government might assert faith in God, but it would not trample on conscience or coerce belief; even those citizens who deny the existence of God deserve life, civil liberty, and religious freedom.

The Declaration then moves through its specific condemnations of Britain’s monarch, explaining how the king has violated the Laws of Nature and Nature’s God and the liberties granted by the Creator. The concluding paragraph then makes a logical shift to the final two references.

It opens with the representatives’ appeal “to the Supreme Judge of the world for the rectitude of our intentions.” This bold invocation asks God to judge not only their words but their motives. This appeal hearkens back to the medieval concept of a trial by combat, where God will vindicate the just and punish the evil. Using an Enlightenment framework, Congress was arguing that virtuous citizens using their reason could achieve a victory by acting in accordance with the moral framework of the universe.

The closing sentence reiterates this belief in God as the cosmic judge. Congress pledges its “firm reliance on the protection of Divine Providence,” knowing that if they are proven wrong they will lose their “Lives,” “Fortunes,” and “sacred Honor.”

Even the least religious of the founders feared the judgment of God. Jefferson references God throughout his “Notes on the State of Virginia,” once again describing God as the Creator of the earth, man, and animals. Man is unique because he is the only animal that can create like the Creator. This sense of humanity as being created in the image of God prompted Jefferson to fear God’s “wrath” on a country that still allowed human beings to enslave one another, for liberty is “the gift of God.” Jefferson, a man deeply troubled by his own guilt in perpetuating slavery, wrote: “Indeed I tremble for my country when I reflect that God is just: that his justice cannot sleep for ever.” The same perfectly ordered and just being whom he believed would protect America during the Revolution would punish America if it did not end slavery.

So why does exploring the founders’ reliance on God in the Declaration matter today? Because it is the most fundamental matter at the root of every political question. Why are humans equal? Because God created them so. Why do all humans have dignity? Because they are created in the image of God. Why can government not solve every problem? Because it is not God. Why can our magistrates wage war or kill criminals? Because God delegated authority to civil government to punish evil and promote good. Why is governmental power limited in society and why must it protect human liberty? Because God distributed power to other human institutions (such as the family and the church), and every human being has a unique soul.

Civic theism for the authors of the Declaration moved beyond a narrow set of religious practices or beliefs. Individual founders differed in their doctrines, and yet they unanimously advocated for a theistic republic. It was built on the premise that a good God not only created the world but demanded justice, liberty, and equality from those who govern it. Remove its foundation, and a republic such as this is doomed to fracture and collapse.

TAXED TO DEATH IN GEAUGA COUNTY??-- VOTE NO ON KENSTON SCHOOLS ISSUE 20

Friday, November 3, 2023

Quite frankly, we cannot ever remember a time in Geauga County when the impact of a debilitating tax burden has become such a looming threat to residents-- a large portion of whom are, by no choice of their own, dealing with the burden of fixed incomes and/or uncertain economic times. Many of the voters struggling to decide whether to buy groceries, pay utility bills, or simply maintain the premises are being squeezed by unfulfilled promises that have been made by well-paid Kenston administrators.

The last Kenston School levy failed on May 4, 2021, the first time in our 25 year Auburn Township memory.

On Sunday, April 25, 2021, we published an analysis of before-and-after tax consequences to properties on Crown Point. The entry was entitled “What Happens to Bainbridge Taxpayers if the Kenston Schools Continual Levy Passes in Special Election on May 4?” We are also republishing an entry made by School Board Candidate, Dennis Bergansky on Friday, April 30, 2021 “Sampling of Posts about Kenston School 6.5 Mill Levy on Nextdoor Neighbors.” Bergansky in the thread remarked, “It’s interesting how many [Kenston School] employees support the levy but will tell you they can’t afford to live here. . . and that was before this proposed levy.” In each case, the evidence demonstrated that the Kenston Schools were top-heavy with administrators and support staff [teachers, guidance, niche special education).

As a result, Dennis Bergansky was elected to his current School Board member position and the 6.5 mill levy was overwhelmingly defeated on May 4, 2021. Kenston Superintendent, Nancy Santilli, got the message and left the system (at a salary of $144K plus health insurance and retirement benefits) to an interim Administrator. On April 30 Bergansky further revealed that “No one would have ever known about the 10 million revenue surplus if it wasn’t for a school employee that found it hidden away in an inner office memo. Too many lies!”

Have the pro-Kenston levy marketers learned anything about the excess carryover funds for which Kenston Schools have become well-known in spite of a PERMANENT Superintendent [as of school-year 2023-2024 earns in excess of $155,000 who now promotes support of Issue 20, a 5-year Permanent Improvement (PI) Levy and again cites that “a home with an appraised value pf $300,000- would pay approximately $12/month” so that there can be a specific fund for parking lot improvement and eventual bus replacement.

Several public meetings held by the Geauga County Budget Commission document that the Kenston LSD will imminently come into a $1,117,487 revenue windfall as a result of the 2023 sexennial revaluation of inside millage.. West Geauga Local School District, in the midst of a $1,259,169 windfall, has already expressed transparency by promising the Geauga Budget Commission help in mitigating the squeeze on registered voters. We hope that Kenston LSD will step up to the bat to relieve the pain on its taxpayers.

We urge the Kenston Local School District to demonstrate its willingness to aid its taxpayers, many of whom are squeezed to the breaking point, So far, unfulfilled promises and jumping ship rather than making hard decisions as a community do not speak well for Kenston LSD or its “pro-Yes” committee.

I, as public school educator, retired for over 20 years, cannot morally, ethically, or financially support this latest boondoggle. We urge the district to respond favorably to the letter it received on October 18th from the Geauga County Budget Commission.

To our public readership, we urge all qualified voters within the Kenston School District and potentially impacted by the District’s unfulfilled promises to vote on November 7.

VOTE NO on "ISSUE 20" NOVEMBER 7th!

LAKE COUNTY’S OUT OF CONTROL PROPERTY TAXES

October 28, 2023By Brian Massie, A Watchman on the Wall, lobbyistsforcitizens.com

We have been warning about the out of control property taxes for at least

eight years. We have publicly stated at Commissioners’ meeting, and at many

local gatherings that if we stay on the path of ever-increasing property taxes,

we will price seniors and others living on fixed incomes out of their homes that

they have worked all their lives to achieve.

We have been warning about the out of control property taxes for at least

eight years. We have publicly stated at Commissioners’ meeting, and at many

local gatherings that if we stay on the path of ever-increasing property taxes,

we will price seniors and others living on fixed incomes out of their homes that

they have worked all their lives to achieve.Please follow this link and read what is happening in Geauga County. They have just experienced the impact of the sexennial property revaluation since they are one of several counties that had their revaluation occur in 2023 with taxes collected in 2024.

We are working on calculating the impact of the sexennial revaluation, required by the Ohio Revised Code, for Lake County property in 2024. In a discussion with the Lake County Auditor, he confirmed that there will be at least an overall 30% increase in residential and agricultural property (known as Class l). The increase in property taxes will be collected in 2025.

This will bring additional revenue to all school districts and political sub-divisions that collect inside millage, which is collected WITHOUT a vote of the taxpayers! Citizens in the Willoughby-Eastlake, Kirtland, and Perry School Districts will be shocked at the increases if nothing is done by the State Representatives to lessen the burden. Their school districts are at the 20 mill floor, therefore their general outside levies will the treated like inside millage. This means they will get massive increases in property taxes without being able to vote on the new taxation.

I was told that our system of funding with property taxes only works with a 1% – 2% annual increases in property values, and the spikes in valuation cannot be tolerated by the taxpayers.

We must bring to our readers’ attention that our system of checks and balances is broken in Lake County. The Lake County Budget Commission is supposed to be the watchdog for the taxpayers to ensure that excessive taxation does not take place.

However, due to the Lake County Prosecutor Charles Coulson’s interpretation

of an Ohio Supreme Court ruling any outside millage levy voted on by the

taxpayers cannot be reduced by the Budget Commission. Consequently, the Budget

Commission is merely a “rubber stamp” for the various political subdivisions,

thereby allowing them to accumulate obscene amounts of money, far more than they

need to operate.

However, due to the Lake County Prosecutor Charles Coulson’s interpretation

of an Ohio Supreme Court ruling any outside millage levy voted on by the

taxpayers cannot be reduced by the Budget Commission. Consequently, the Budget

Commission is merely a “rubber stamp” for the various political subdivisions,

thereby allowing them to accumulate obscene amounts of money, far more than they

need to operate.

Geauga County does not operate as Lake County does, and their Budget Commission can protect the taxpayers. Their is NO ONE in Lake County government that is protecting the financial interests of the Lake County taxpayer by reducing existing property taxes.

We are losing the American Dream one tax levy at a time. This is not political it’s Biblical!

The Crime Lab, under the direction of Coulson, has accumulated over $7 million in surplus cash, and accumulates over $1.6 million annually over their needs to operate the lab. Coulson justifies this because he will not have to come back to the taxpayer for additional taxes for at least 15 years. He made the last crime lab levy “continuous” so that the property taxes are collected each year without having to justify the need to the taxpayers. In our opinion, it appears he honestly believes that it is acceptable for a political subdivision to hoard cash.

The political subdivisions are “sucking the lifeblood out of the community” with their excessive taxation. It is our contention that the money belongs in the hands of the taxpayers so that they can meet their financial needs and stimulate private growth by spending money in the community.

As of September 30, 2023, your Lake County government had $448,655,404 invested, and earned approximately $12 million this year in investment income. This includes $60 million owned by the Developmental Disabled entity known as Deepwood. When we add in the cash reserves of Lake Metroparks, Laketran, ADAMHS Board, Lakeland Community College, school districts, and the other non-profits feeding at the government trough, we realize that local government is growing out of control. Their growth pattern is unsustainable for the local taxpayers to continue funding through property taxes, or sales taxes for that matter.

Stay tuned for our follow up article where we will reveal the additional property taxes by municipality and school district without a vote of the taxpayers that will occur due to the sexennial revaluation. Seeing these increases may influence the voters’ decision about tax levies that are on the November 7th ballot.

It is regretful that officials do not warn the taxpayers about the cliff that they are approaching BEFORE they vote on November 7th.

YOU CAN’T EAT THE GDP

Friday, October 27, 2023

By Jeffrey A. Tucker

Well, that was one of the more interesting haircut experiences I’ve had in a while. The lady cutting my hair told her colleague that she is late on her car payments. The other lady responded that she is too, and they laughed.

The second, however, pointed out that her car is broken and she cannot afford the fix. Then someone else chimed in that his car has been in the shop for weeks and cannot get it out. Then another said her car insurance payments have gone up and that she is considering moving just two blocks over to get out of the high premium district.

I finally just interrupted these tales of woe and asked a normal question. What is going on around here? Someone said “We are out of money.” Then everyone agreed. There is no money and the paychecks aren’t covering the bills so they are juggling them in strange ways, one late this month and another late the next month.

I got curious about all this and started digging in deeper. Are these loan rates adjustable and so changed with the new rates? No, that’s not the case. The problem is that while salaries and wages paid the bills a few years ago, now everything is much more expensive, and raises are not keeping up. Saving money is out of the question. At this point, they are just trying to keep the bill collectors at bay.

Does any of this sound familiar to you? I would bet it does. It’s a normal experience these days, such that the middle class is being squeezed from both ends. They are deeply in debt but cannot sell cars or homes because they would have to acquire new ones and take on debt that is much more expensive. So they hold on to what they have. In real terms, everything is vastly more expensive today than it was three years ago.

I’ve never heard such conversations in a haircut place before. People are very open about this because they know other people share the same issues, thus removing the shame. It’s a shared plight. Meanwhile you have the major media out there saying that the economy is red hot and growing robustly. At this point, we have to ask: growing for whom? It’s not the class of people who could previously count on a good job as a means of paying the bills.

Understandably, this whole problem has got many people in bad moods. They are snapping at friends and vexed with financial problems that have forced vast numbers to downgrade their spending, and turn an envious eye toward the rich, which can be dangerous. This gradual decline in living standards expresses itself in growing incivility which itself shows up in strange ways, from public griping at the barbershop to organized shoplifting at street-level retail shops.

And yet we don’t call it a recession, even though every hard signal shows we are already in one. Government tax revenue has fallen precipitously exactly as it has in every recession previously declared since World War II. There are two reasons: the unemployment rate and the positive Gross National Product.

The labor numbers are clearly distorted by labor dropouts and double-counting of multiple job holders. People trading full time jobs for multiple part-time jobs does not seem like economic health.

Today is the day to talk about the GDP. The headlines, as expected, were wild with excitement because the data shows a 4.9 percent annualized increase for the third quarter. CNN says that this growth is “staggering.” I’ve come to distrust any news report that deploys this term: it is an exhortation to how you are supposed to respond.

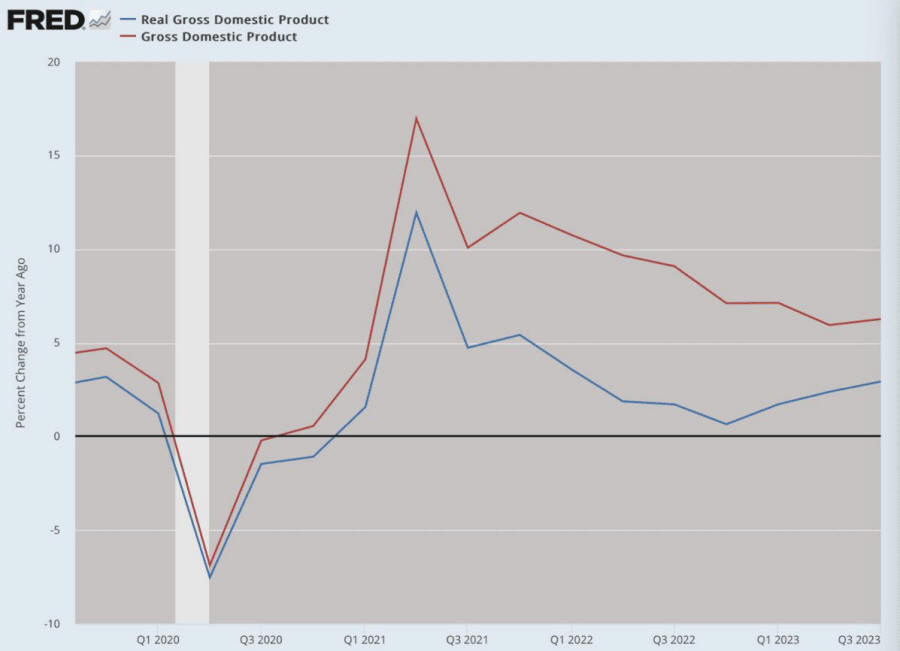

Maybe it’s better just to stick to the facts. These days, nothing is as it seems. For example, the Commerce Department reports 4.9 percent 3Q increase real GDP as annualized data. But if you look at year-over-year change, it is only 2.9 percent. Here is an example of how sensitive these reports are to how you render them.

Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker

Let’s take a closer look.

What goes into the calculation of the GDP? The formula is: the sum of consumption (C), investment (I), government Expenditures (G), and net exports (X—M). C is a calculation of consumer spending, but it does not include growing debt. Investment is what businesses spend on plants, research, equipment, and so on. Both fundamentally depend on accurate collection techniques and those have been broken for years.

As for expenditures, that’s government spending and that’s absurd. Government spending detracts from wealth creation. Only the most diehard Keynesian fossil would believe otherwise, and yet this fallacy continues. And the trade data are skewed by a weird mercantilist bias that supposes that exports are always good and imports bad.

You see, there is no magic machinery in the sky that observes the operations of the world and spits out a number to tell us whether we are making wealth or not. These huge aggregates are always garbage in and garbage out. They are also seriously subject to political manipulation, and I swear that no presidential administration has toyed with this trick more than the Biden administration.

The newest release is more evidence of that.

A closer look shows two large drivers: more consumer spending, which is hardly a surprise given things, and a very large increase in government spending at the federal and state levels. Federal government spending is up 6.2 percent, with the large share of that on military spending (8 percent increase). That accounts for why government debt is up $600 billion in one month! This stuff is out of control, insane, and yet being rendered as economic growth.

It’s true that investment is up too but when you drill down into that, the largest increase is in intellectual property products, meaning navigating the patent thick for drugs, software, and various technical deployments. It’s not the place for an extended argument on this topic (maybe someday) but this is not economic growth. It’s a cost of regulation, as anyone in the affected industries can tell you. It takes some extreme juggling to re-render this mess as a contribution to national wealth.

As for consumer spending, it is up but check it out: personal for the quarter is down to 3.8 percent, which is extremely low. It’s all the more alarming that this happens in the presence of far higher interest rates. You can get paid now for saving money for the first time in a decade and a half. The problem is that people do not have the discretionary income to take advantage of the new rates for saving.

And speaking of disposable income, here is a devastating detail that is not in the press release and not even in the main tables. You can only find it listed under “addenda.” Disposable personal income is fully negative, falling 1 percent for the third quarter. This nasty little fact is not reported in any news stories I’ve seen, and this is because the Bureau of Economic Analysis did not happen to put this in the press release.

Consider all of this: huge increases in government spending, increased indebtedness, falling savings, and falling disposable income. Let’s just draw on normal human intuition here. Does this seem like economic growth to celebrate?

As E.J. Antoni points out, everything seemingly good about this report actually subtracts from economic growth in the future.

I’m coming to believe that you can learn far more about economic realities from listening carefully at the barbershop than you can from reading press releases from statistical agencies. And incidentally, when today’s numbers get revised lower and lower, that will not make the news.

AUTOMATIC $1,117,490 SEXENNIAL WINDFALL TO KENSTON LOCAL SCHOOL DISTRICT ..... VOTE NO ON ISSUE 20

October 21, 2023

In case any of our readers have forgotten the financial confusion since 2021,

let us remind you of the unprecedented events that have befallen Geauga County

homeowners and voters and have resulted in continual loss of financial

stability: higher property and vehicle insurance annual rates, skyrocketing

prices on healthy food items, especially cuts of meat and fish. More

importantly, many individuals continue to drive well-aged vehicles because of

skyrocketing replacement costs.

Every parcel owner in Geauga County very shortly will receive written

reappraisal mandated by the Ohio State Auditor. Geauga County is one of 28 Ohio

counties subject to the 2023 state-mandated reappraisals with no voter approval.

“Inside millage of 10 mills,” is not voted for by levies. It is automatic and will increase as a result of the reappraisals. The 10 mills are divided with 25% going to Geauga County Government, 30% going to Township or Municipal Government, and a whopping 45% going to Local School Districts. That means a “whopping 45% increase” in taxes to the Kenston School District. With this 45% increase as a result of the reappraisal will Kenston Schools, need Issue 20 to pay for Permanent Improvement?

Worst of all, how many high-paid positions has the Kenston School District retained, including the $130,000+position for Superintendent Sayers, when the latest “state report card”for Kenston has recorded average annual teacher salary of $83,000 in addition to health and retirement benefits? With no mention of the windfall?

As a result of not communicating the entire upfront truth of the

Sexennial Reevaluation, Kenston Local School District will receive an automatic

additional $1,117,489, up from $4,277,436 the previous year-- all on the backs

of its taxpayers, at least 20% of whom are on fixed income with no wiggle room

to endure extra expense.

Taxpayers on fixed income for decades have continued to support Kenston Schools at personal sacrifice and erosion of common comforts and quality of life. What will happen when those who have paid and paid and paid can no longer pay? How will Kenston Schools survive when the inverted base of support crumbles? What can the Issue 20 Committee and the high-paid administrators do to prove how important the taxpayers really are? So far we have seen no real sacrifices made by the recipients of an automatic $1,117,400 Sexennial windfall.

In fact, we refer you to the previous failure of a “continual” levy sought by Kenston Schools on May 4, 2021 (Special Kenston School Levy). If the Kenston Levy Committee takes advantage of the automatic additional increase of $1,117,489 from inside millage windfall with absolutely no consent of the voters, how much longer can the Levy Committee and the paid Kenston staff expect ANY voter trust?

Auburn and Bainbridge taxpayers shortly (before the November 7 election) will receive official notification of some 30% increase in teal-estate bills..

The Fall 2023 “In the Know” pro-levy bulletin reports “the district has had to transfer $575,000 annually from the general operating budget to the Permanent Improvement budget, implying that the transfer has negatively impacted education (p.1) without informing the public of the sexennial windfall and complains about a prospective $1,265,000 “permanent improvement” expense without total candor.

VOTE NO on Tuesday, November 7, on KENSTON SCHOOLS ISSUE 20.

GOOGLE CLOUD, AWS, AND CLOUDFLARE REPORT LARGEST DDOS ATTACKS EVER

Wednesday, October 11, 2023

By

Steven Vaughan-Nichols

Monster DDoS attacks hit Google Cloud and other major internet services.

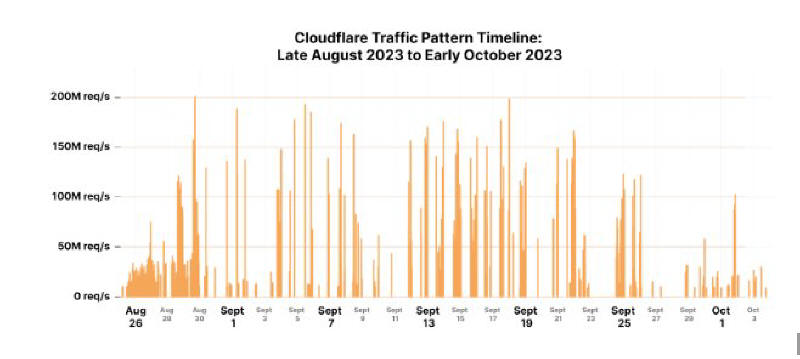

Editors’ note: This attack was not your garden variety hacker. This article did not include nor reference the attacks that also occurred on Microsoft's Azure and M365. We have read reports of this series of DdoS attacks starting on August 29 and continuing through September of 2023.

Distributed Denial of Service (DDoS) attacks may be one of the least sophisticated types of cyberattacks but they can do real damage. Now Google and other top cloud companies are reporting new records for the largest DDoS attacks ever.

|

The Google Cloud was hit by the largest DDoS attack in history this past August, with the digital onslaught peaking at an unprecedented 398 million requests per second (RPS). How big is that? According to Google, in two minutes, the Google Cloud was slammed by more RPS than Wikipedia saw in all of September 2023.

That's big. The attack on Google Cloud, which employed a novel "Rapid Reset" technique, was 7½ times larger than any previously recorded DDoS attack. 2022's largest-recorded DDoS attack peaked at "only" 46 million RPS.

Google wasn't the only one to get hit. Cloudflare, a leading cloud delivery network (CDN), and Amazon Web Services (AWS), the world's biggest cloud provider, also reported getting blasted. Cloudflare fended off a 201 million RPS attack, while AWS held off a 155 million RPS assault.

These DDoS attacks began in late August and "continue to this day," according to Google, targeting major infrastructure providers. Despite the scale and intensity of the attacks, the top technology firms' global load-balancing and DDoS mitigation infrastructure effectively countered the threat, ensuring uninterrupted service for their customers.

In the attacks' wake, the companies coordinated a cross-industry response, sharing intelligence and mitigation strategies with other cloud providers and software maintainers. This collaborative effort developed patches and mitigation techniques that most large infrastructure providers have already adopted.

The "Rapid Reset" technique exploited the HTTP/2 protocol's stream multiplexing feature which is the latest step in the evolution of Layer 7 attacks. This attack works by pushing multiple logical connections to be multiplexed over a single HTTP session.

This is a feature "upgrade" from HTTP 1.x, in which each HTTP session was logically distinct. Thus, just like the name says, an HTTP/2 Rapid Reset attack consists of multiple HTTP/2 connections with requests and resets one after another. If you've implemented HTTP/2 for your website or internet services, you're a potential target.

In practice, Rapid Reset works by a series of requests for multiple streams being transmitted, followed immediately by a reset for each request. The targeted system will parse and act upon each request, generating logs for a request that is then reset, or canceled. Thus, the targeted system burns time and compute generating those logs even if no network data is returned to the attacker. A bad actor can abuse this process by issuing a massive volume of HTTP/2 requests, which can overwhelm the targeted system.

This is actually a turbo-charged version of a very old kind of attack: The HTTP flood request DDoS attack. To defend against these sorts of DDoS attacks, you must implement an architecture that helps you specifically detect unwanted requests as well as scale to absorb and block those malicious HTTP requests.

The vulnerability exploited by the attackers has been tracked as CVE-2023-44487.

Organizations and individuals serving HTTP-based workloads to the internet are advised to verify the security of their servers and apply vendor patches for CVE-2023-44487 to mitigate similar attacks. The patches are on their way. But, until they're widely installed, I guarantee we'll see more Rapid Reset attacks.

Most companies don't have the resources needed to deal with such attacks. You need extensive and powerful network DDoS defensive services such as Amazon CloudFront, AWS Shield, Google Cloud Armor, or CloudFlare Magic Transit to fend off Rapid Reset attackers.

Eventually, the fix will be in for this particular attack, but similar ones will soon be on their way. As the security saying goes, "Security isn't a product, it's a process."

CAVANAGH REMEMBERS ON OCTOBER 2: TOWNSHIP’S INITIAL “LEVY OOPS” REQUIRES BIGGER ROAD PAYMENTS AT MARCH 2024 ELECTION

Tuesday, October 3, 2023

Unopposed in his latest run for Auburn Township Trustee on November 7, Patrick Cavanagh, assumed the voice of Trustees Troyan and McCune when he looked back to the confusion that was created when he was one-third of the triumvirate composed of Troyan, Eberly, and Cavanagh that decided to renew one of the three 1-mill road levies one year early. It would seem that such a decision threw everybody, including themselves off, resulting in an illegal/unauthorized collection of a road levy for years, and years, and years. Fiscal Officer Dan Matsko has been required to take the illegal road levy off November 7 General Election ballot.

The cost to remove an item from the ballot reminds us of the 10% finance charge that taxpayers get socked when they can’t pay off their real estate bills.

Malfeasance, misfeasance, or nonfeasance? Why will spring 2024 (when the oops road levy will be official once again) dig into the pockets of innocent Auburn Township voters.

Who will rescue overwhelmed and overburdened taxpayers from the swamp?

SAVE OUR GEAUGA HOMES. VOTE NO KENSTON SCHOOLS ISSUE 20 ADDITIONAL PERMANENT IMPROVEMENT LEVY

Tuesday, October 3, 2023

Within the last month, those individuals collectively known as “We Care for Kenston” targeted “parent, grandparent, employer in our community, supporter of students or a resident of the district” to emotionally cajole voters in the November 7, 2023, to pass a so-called Permanent Improvement levy for just 5 years at a time when homeowners and Geauga County taxpayers are being bombarded from all directions with unprecedented increases in the costs of the most essential of basic needs and comforts. In fact, Treasurer Chris Hitchcock conceded that in his long and unchallenged career, he has never seen so many signs of an impending economic disaster; his Deputy Treasurer identified the 2023 Six-Year Reevaluation dictated by the Ohio Auditor of State upon Geauga County taxpayers as “the perfect storm” for residential owners and longtime owners of farms to be financially overwhelmed with real-estate tax obligations that impose an additional 10% penalty if not paid in full by February 21, 2024.

For the record, Geauga County home valuations will increase by 30%; that increase in home value will squeeze individuals out of their residences, particularly if they are elderly and rely on a fixed income to survive. Individuals who have been involved with agriculture and/or animal husbandry, must endure the agony of passing a “Permanent Improvement Levy” while enduring a 300% increase in the tax value of their farmland (CAUV).

Kenston Schools apparently did not catch the drift when their request for a continuous school levy in Spring 2021 was convincingly rejected by an electorate that does not and will not share in the excessive salaries earned by its Superintendent, Guidance Counselors, and Support Staff and by the families who leave the community as soon as their children graduate to achieve some relief from the taxes. Or consider the longtime loyal families who have sacrificed their own comforts for decades after their own children graduated. Those property owners who remain will now be asked to pick up an even larger share of the expense.

We understand that the County Treasurer’s office is already aware of the growing anger among taxpayers who have already voiced discontent. Just wait until the Treasurer’s Office mails the Geauga County real estate bills in early January 2024 to those taxpayers who bought the group identity of “We Care for Kenston” and then had to abandon long-held and long-loved Geauga County property because No One Cares for those who can no longer pay and pay and pay for Kenston administrators and support staff.

As defined in their rationale, “We Care for Kenston” has identified Issue20 as a “5-year, 1.35 mill permanent improvement (PI)levy” that will provide dedicated funding “for much needed maintenance and repairs as well as safety and technology improvements across the District.” Have those touting the limits of Issue 20 defined the limits of technology improvements across the District? The elimination of one administrator and/or the peanut concessions made thus far from retirement/ attrition alone do not excuse Kenston Local Schools from robbing from taxpayers.

Every Kenston voter who has paid over 60% of his February and July real estate bill to the Kenston Local Schools with NO relief in sight is being pinched in a vice. We, as long-time educators and learners ourselves, will be voting NO on Issue 20.

Every Kenston voter, who is paying over 60% of his real-estate tax bill to fund the Kenston School System, is being suffocated in an avalanche. VOTE NO ON ISSUE 20!